|

| County Executive Steuart Pittman joined FOP 70 in our fight for passage of the long overdue "Social Security Fairness Act". |

|

We are happy to report that on June 3, 2024, Senator Ben Cardin joined Senator Chris VanHollen and Maryland’s Congressional representatives David Trone, Kweisi Mfume, John Sarbanes, Dutch Ruppersberger, Glenn Ivey, and Jamie Raskin seeking to repeal provisions that cut our Social Security benefits up to 60%.

There are now a record 322 Co-sponsors (210 Democrats and 112 Republicans), making this bill the SECOND-most supported legislation in Congress today.

Thanks to our collective efforts, we secured the sponsorship of Senator Ben Cardin. We have still not been able to convince Congressional representatives Andy Harris or Steny Hoyer to co-sponsor this important legislation. All we are asking for is to receive the benefits that we pay for.

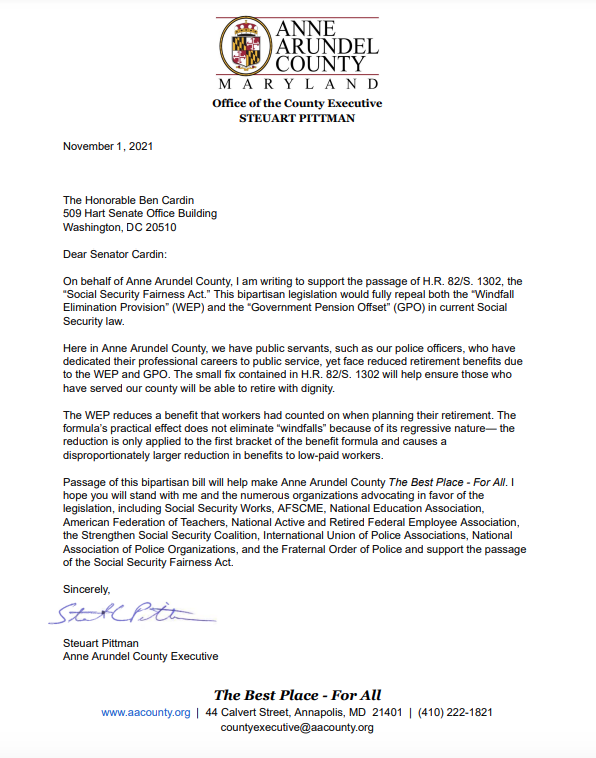

A letter from County Executive Steuart Pittman to U.S. Senator Ben Cardin on the Social Security Fairness Act.

November 1, 2021

The Honorable Ben Cardin

509 Hart Senate Office Building

Washington, DC 20510

Dear Senator Cardin:

On behalf of Anne Arundel County, I am writing to support the passage of H.R. 82/S. 1302, the “Social Security Fairness Act.” This bipartisan legislation would fully repeal both the “Windfall Elimination Provision” (WEP) and the “Government Pension Offset” (GPO) in current Social Security law.

Here in Anne Arundel County, we have public servants, such as our police officers, who have dedicated their professional careers to public service, yet face reduced retirement benefits due to the WEP and GPO. The small fix contained in H.R. 82/S. 1302 will help ensure those who have served our county will be able to retire with dignity.

The WEP reduces a benefit that workers had counted on when planning their retirement. The formula’s practical effect does not eliminate “windfalls” because of its regressive nature— the reduction is only applied to the first bracket of the benefit formula and causes a disproportionately larger reduction in benefits to low-paid workers.

Passage of this bipartisan bill will help make Anne Arundel County The Best Place - For All. I hope you will stand with me and the numerous organizations advocating in favor of the legislation, including Social Security Works, AFSCME, National Education Association, American Federation of Teachers, National Active and Retired Federal Employee Association, the Strengthen Social Security Coalition, International Union of Police Associations, National Association of Police Organizations, and the Fraternal Order of Police and support the passage of the Social Security Fairness Act.

Sincerely,

Steuart Pittman

Anne Arundel County Executive

The Best Place - For All

www.aacounty.org | 44 Calvert Street, Annapolis, MD 21401 | (410) 222-1821 countyexecutive@aacounty.org

___________________________________________________________________________________________________________________

The FOP strongly supports the passage of H.R. 82/S. 1302, the “Social Security Fairness Act.” This legislation would fully repeal both the “Windfall Elimination Provision” (WEP) and the “Government Pension Offset” (GPO) in current Social Security law. The bill has not yet been introduced in the Senate.

The WEP was enacted in 1983 as part of a large reform package designed to shore up the financing of the Social Security system. It went into effect in 1985 and applies a modified formula designed to reduce the amount of the Social Security benefits received by individuals who collect a government pension. The ostensible purpose of the WEP is to remove a “windfall” for persons who spent some time in jobs not covered by Social Security (like public employees) and also worked other jobs where they paid Social Security taxes long enough to qualify for retirement benefits. The practical effect of the provision on low-paid public employees outside the Social Security system is that they lose up to sixty percent (60%) of the Social Security benefits to which they are entitled—a loss, not an adjustment, for a “windfall.” This creates a very real inequity for many public employees, particularly police officers, who retire earlier than other government employees to begin second careers which require them to pay into the Social Security system.

We regard this as an issue of fairness, as these public employees are unfairly penalized under current law. The WEP substantially reduces a benefit that workers had included and counted on when planning their retirement. The arbitrary formula, when applied, does not eliminate “windfalls” because of its regressive nature—the reduction is only applied to the first bracket of the benefit formula and causes a relatively larger reduction in benefits to low-paid workers. It also overpenalizes lower paid workers with short careers or, like many retired law enforcement officers, those whose careers are evenly split inside and outside the Social Security system.

Like the WEP, the GPO was adopted in 1983 to shore up the finances of the Social Security trust fund. It offsets the dependent’s Social Security benefit to which a spouse or widow(er) is entitled by two-thirds of the monthly amount of any government pension from noncovered employment that the surviving spouse might receive. For example, the wife of a retired law enforcement officer who collects a government pension of $1,200 would be ineligible to collect the surviving spousal benefit of $600 from Social Security upon the death of her spouse. Two-thirds of $1,200 is $800, which is greater than the spousal benefit of $600 and thus, under this law, she would be unable to collect it. If the spouse’s benefit were $900, only $100 could be collected, because $800 would be “offset” by her government pension.

Again, the FOP believes this is a matter of fairness and that the offset scheme currently in place penalizes those employees least able to afford it. Law enforcement officers, who often do not participate in the Social Security system, are especially affected.

The Fraternal Order of Police strongly supports H.R. 82/S. 1302 , the “Social Security Fairness Act.”

Social Security Fairness Act Support Letter1.pdf

Download:

|